Have you ever really sat down to create a real household budget? You’d be surprised at how many people operate without one, which is very scary when you think about it.

Trying to manage your household finances without a game plan is like driving across the country without a road map or not knowing the destination.

Creating a household budget will help you to stay on track and make sure you have enough money each month to pay your bills and have money for anything extra that may come up.

No matter how painful paying the bills are, doing so is the responsible thing to do. And one of the best ways to maintain control over your finances is to use a monthly bill tracker.

There is absolutely no reason to complicate the management of your monthly bills because simplicity is the key to success.

Budgeting is not just about restricting spending and living a cheapskate life.

It is about insights, wisdom, informed decisions, action, and sustained discipline when it comes to your household financials.

This article will provide you with a brief overview of the basics of household budgeting.

It will focus on practical application and a few best practices that you can easily apply to your own budget.

This information empowers you to put together a dynamic, financial plan that suits your pocketbook, means, and circumstance.

The purpose and goal of household budgeting are:

- Financial Situational Analysis And Informed Awareness

- Cutting Cost

- Gaining Control Or Curbing Spending

- Starting To Save, Building Up Wealth And Liquid Assets Over Time

As you read through the 5 household budget tips, answer the following questions in order to assess quickly where you think you and your family are today financially:

- What kind of picture do you have?

- Could you come up with something?

- Did you have the data and numbers you needed?

- Would you be able to plan for where you want to be and start living your life today as a fiscally sound and disciplined family with the information you have at your disposal at present?

Despite what anyone says, money makes the world go round! It is no secret that some of us have more, and some have less.

We deal with our own personal finances and cash management distinctly differently.

Households have varying needs, means, and circumstances. Our money-management skills are also at different levels, as are our debt and savings!

Life can be tough and there are plenty of roadblocks that get in our way.

There’s no such thing as equality, which means that we’re not on an equal playing field.

Some people have more wealth than others.

Regardless of how much money you make, creating a budget is one of the best ways to manage it.

A budget helps you to spot the money leaks, which allows you to save and even invest some of it.

I suggest that you use a Financial APP or a Monthly Bill Tracker to manage your budget.

At the very least, use a Spreadsheet Program that will hold all of your financial data.

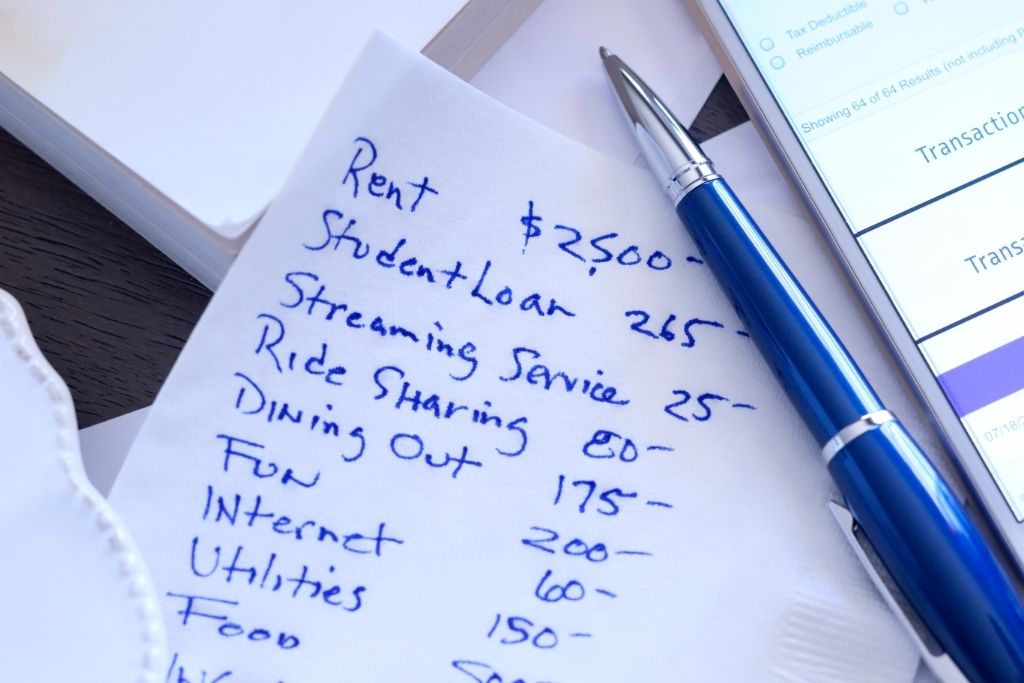

You’ll need to include your income, monthly expenses, yearly expenses, and room for anything else that may come up.

These would include items such as vehicle repairs, school costs, going out to the movies, and other things along those lines.

Here are some household budgeting basics to help you get started…

1)) Income

The first thing on your spreadsheet would be your income. You’ll want to include everything you may have such as paychecks, secondary income, child support, bonuses, and other forms that may only come once a year like tax refunds or gifts.

2)) Monthly Expenses

Monthly expenses are the next thing to add to your spreadsheet. These would include credit card payments, utility payments, loan payments, and anything else that you pay on a monthly basis.

You’ll want to have monthly amounts and due dates so you can place these under your income where it comes in each month.

3)) Yearly Expenses

Yearly expenses may be a bit of a challenge to include, but it’s a good idea to do it. This will help you avoid the stress of coming up with the money when they come due each year.

This means you’ll need to create a spreadsheet for each month for the entire year so you can include these types of expenses because you don’t want them to creep up on you.

4)) Extras

Extras are hard to budget for which is why you should try to plan on them each month.

Putting money into a savings account will help you to have the money when the time comes.

It’s nearly impossible to plan for vehicle repairs or emergencies, so a savings account will help to ease the burden when these types of things come up.

You can plan on maintenance to your vehicle or yearly checkups with your doctor, but there are times when even these things don’t help, so planning ahead can provide a nice safety net.

5)) Vacations

Planning a vacation can be challenging, not to mention pricey, but when you set up your budget correctly, you’ll be able to include it in your month-to-month budget.

Your savings account will help with this plan as well.

You’ll be able to see where you have a little extra money and you’ll have the ability to put some money back, which will allow you to take a vacation when you’re ready.

Conclusion

Creating a household budget will help you to spend your money wisely and reduce your chances of forgetting miscellaneous expenses.

When it comes to number-crunching, it’s nearly impossible to remember everything, so creating a spreadsheet or using an APP with all of your expenses and extra things you want will help you to maintain your budget so you can make everything happen.

Not to mention, help you maintain your sanity.

You’ll have the ability to see the big picture, which will help you to see what you can do to increase your income and lower your expenses so you have more money at the end of the month.

Household budgeting is one of those activities that none of us truly value until we see or feel it makes a difference.

If you stick with it long enough, are disciplined, and are committed, you will experience the dynamic impact and life-altering influence and contribution of this tool and process.

Have fun creating your household budget!

Download Our Free E-book!