Creating an emergency fund is a financial priority that everyone should strive to achieve, regardless of income level.

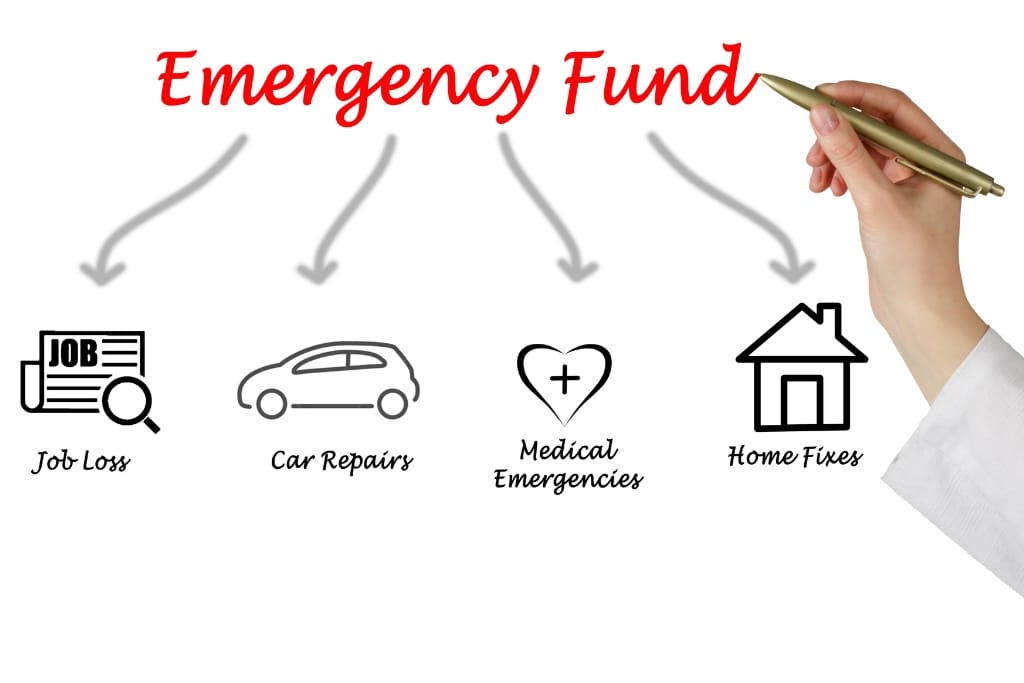

Life often throws unexpected challenges our way, such as unforeseen medical bills, home repairs, or even temporary unemployment, and these can quickly derail your financial stability if you’re unprepared.

An emergency fund acts as a buffer, protecting you from relying on credit cards or loans during tough times.

While saving money on a limited budget may seem challenging, it’s far from impossible when approached with intentionality and a clear plan.

By breaking the process into manageable steps and making small, consistent changes to your spending and saving habits, you can lay the foundation for financial security.

With determination and the right mindset, you can start building an emergency fund that safeguards your future and offers peace of mind.

Let's explore practical ways to make this goal a reality.

1)) Set Realistic Savings Goals

When starting to build an emergency fund, it’s crucial to establish realistic and achievable savings goals tailored to your specific circumstance.

Begin by assessing your financial situation, including monthly income, essential expenses, and discretionary spending, to determine how much you can comfortably set aside.

Going for a goal like saving three to six months’ worth of living expenses may be overwhelming at first, so break it down into smaller, incremental targets.

For instance, your initial objective could be to save $500 or $1,000 as a starter fund, which is often enough to cover minor emergencies like car repairs or unexpected medical expenses.

Tracking your progress toward these milestones can help keep you motivated while building confidence in your ability to save.

Remember, consistency is more important than the amount—regularly contributing even small amounts over time will build up and eventually lead to significant results.

Establishing a timeline and remaining focused can turn what seems like a daunting task into an achievable financial lifeline.

Pro-Tip: Staying organized is key when working toward your savings goals, and a printable paycheck budget planner can be a game-changer.

By visually mapping out your income, expenses, and savings allocations for each pay period, you’ll gain a clearer understanding of where your money is going and how much you can consistently save.

Budget planners make it easier to prioritize your savings goals and monitor your progress, ensuring you stay on track without breaking your budget.

Start by downloading a budget planner that suits your style, and commit to filling it out regularly.

Don’t wait—grab our printable paycheck budget planner today and take the first step toward controlling your finances and building your emergency fund!

2)) Track All Expenses

One of the most effective steps toward building an emergency fund is gaining a clear understanding of where your money is currently going.

Start by tracking every expense, no matter how small, to identify spending patterns and pinpoint areas where you can cut back.

This can be done using budgeting apps, spreadsheets, or even a simple printable monthly bill tracker—whatever method works best for you as long as it's consistent.

Pay close attention to discretionary spending, such as dining out, subscriptions, and entertainment, as these areas often present opportunities for savings.

By categorizing your expenses into fixed (non-negotiable) and variable (flexible) costs, you can better prioritize your spending and find ways to direct more funds toward your savings.

Awareness is the first step to control, and having a comprehensive picture of your finances allows you to make more informed decisions about how to allocate your income effectively.

Regularly reviewing and revisiting your tracked expenses ensures that you stay on course and helps reinforce mindful spending habits over time.

3)) Cut Non-Essential Spending

Reducing non-essential spending is a powerful way to free up funds for your emergency savings without significantly altering your essential lifestyle.

Start by evaluating your discretionary purchases—things like dining out, entertainment subscriptions, coffee shop visits, and impulse buys.

While these expenses may seem small individually, they can add up to a significant amount over time.

Prioritize what truly adds value to your life and consider scaling back or eliminating expenses that don’t align with your financial goals.

For example, instead of dining out frequently, try meal prepping or cooking at home, which often saves considerable money.

Similarly, cancel unused or rarely used memberships and subscriptions, or switch to less expensive alternatives.

Even small changes, like brewing your coffee or setting a budget for entertainment, can make a big difference over time.

Cutting non-essential spending is not about depriving yourself but about being intentional with your financial choices.

Redirecting these savings toward your emergency fund will not only help you build financial security but also instill habits of mindful and purposeful spending.

4)) Automate Savings Deposits

Automating your savings deposits is an easy and effective way to ensure consistent progress toward your emergency fund without relying on willpower or memory.

By setting up automatic transfers from your checking account to a dedicated savings account, you can make saving a regular, hassle-free part of your routine.

This approach allows you to “pay yourself first,” treating your savings as a non-negotiable priority before spending money on other expenses.

Choose a specific amount to transfer—whether it’s a percentage of your paycheck or a fixed dollar amount—that fits comfortably within your budget.

Scheduling deposits to coincide with payday can further simplify the process and ensure that funds are set aside before you’re tempted to spend them.

Using a separate savings account that’s not directly linked to your checking account can reduce the temptation to withdraw funds unnecessarily.

Over time, automating your savings makes the process seamless and helps you build your emergency fund gradually, creating a solid financial cushion without requiring constant effort or attention.

5)) Use Cashback And Rewards Programs

Leveraging cashback and rewards programs is a smart strategy to increase your savings without extra effort.

Many credit cards, apps, and loyalty programs offer incentives like cashback, discounts, or points for everyday purchases.

When used responsibly, these programs can be an effective way to accumulate additional funds for your emergency savings.

Start by analyzing your regular spending habits and identifying programs that align with those expenses, such as cashback on groceries, gas, or online shopping.

Redeem rewards or cashback periodically and deposit them directly into your emergency fund to accelerate your progress.

Be mindful of promotional opportunities like sign-up bonuses or special offers that can help you earn even more.

However, it’s important to remain disciplined—avoid overspending or making unnecessary purchases just to earn rewards, as this can negate the benefits.

When used strategically and thoughtfully, cashback and rewards programs can turn routine spending into meaningful contributions toward building a financial safety net.

6)) Sell Unused Items

Selling unused or unwanted items is a practical and efficient way to generate extra money for your emergency fund while also decluttering your space.

Begin by going through your home and identifying items that no longer serve a purpose or bring you joy.

These could range from clothing and accessories to electronics, furniture, or hobby equipment that you no longer need.

Once you’ve gathered these items, consider selling them through online marketplaces, such as eBay, Facebook Marketplace, or local buy-and-sell apps.

Garage sales and consignment shops can also be effective avenues for turning your items into cash.

When listing your items for sale, take clear, appealing photos and write accurate, detailed descriptions to attract buyers and secure fair prices.

By giving these unused belongings a second life, you not only help others access items they might need but also unlock hidden value within your household.

The proceeds from these sales can then go directly into your savings, bringing you one step closer to achieving your financial goals.

This approach not only contributes to your emergency fund but leaves you with a more organized and streamlined living environment as well.

7)) Start A Side Hustle

Starting a side hustle is an excellent way to boost your income and accelerate the growth of your emergency fund.

By dedicating your spare time to a side job or passion project, you can generate extra cash while potentially building skills and exploring interests.

Consider leveraging your existing abilities or hobbies to create a source of income—this could involve freelance writing, graphic design, tutoring, or even offering services like photography or pet sitting.

For those with spare belongings or underutilized spaces, platforms like Airbnb or Turo allow you to earn money by renting out rooms or vehicles.

Signing up for gig-based opportunities such as food delivery, ridesharing, or selling handmade products online can provide flexible options to earn on your schedule.

The key is to find something that fits into your lifestyle without becoming overwhelming or disruptive.

The additional income from a side hustle can be directed straight into your emergency savings, bringing you closer to achieving financial stability.

It can also serve as a long-term asset, giving you a backup income stream or even evolving into a full-time venture down the line.

Conclusion

Building a solid emergency fund is an essential step toward achieving financial security and peace of mind.

By implementing small and consistent habits like automating your savings, using cashback and rewards programs wisely, selling unused items, and exploring side hustles, you can make steady progress toward your goals without feeling overwhelmed.

These strategies are not only practical but also empower you to take charge of your finances with thoughtful and disciplined actions.

Creating a safety net is not about perfection or making grand leaps—it’s about persistence and dedication over time.

Every small contribution counts and brings you closer to having the financial protection you need for unexpected challenges.

With determination and smart financial decisions, you can create a more stable future that provides confidence and security, no matter what lies ahead.

Download Our Free E-book!