Do you often find yourself asking, “what happened to all of my money” at the end of the month and have no idea where it went?

For millions of people around the world, this is a common occurrence.

No matter how much money any of us makes, proper management of it is a must, even when you believe doing so will not make a bit of a difference financially.

Keeping track of your income and expenses will help you when it comes to paying bills, saving money, and having the ability to do those extra enjoyable things.

If you’ve been wanting to save money, but feel it’ll be a waste of time to even try, then I challenge you to keep track of your spending for the next 30 days.

You’d be shocked at where your hard-earned cash is going because it’ll be a real eye-opener.

Keeping track of your income and expenses gives you the ability to make spending and saving adjustments with precision.

This approach increases the possibility of making your money go further.

Taking control over your cash flow allows you to do things such as:

- Create A Stable Livelihood

- Save Money

- Pay Off Debt

- Purchase A Home

- Make Home Improvements

- Take Vacations

- Buy A New Vehicle

- Afford Vehicle Maintenance/Repairs

- Help Loved Ones Financially

- And The List Goes On

If you mismanage your money, those extras like vacations usually won't happen and you'll struggle and stress when emergency situations arise, such as when your vehicle breaks down or your basement floods.

Have you ever tried to manage your budget in your head and found this approach doesn’t work very well?

I don’t know of anyone on this planet that can remember how they spent every penny, let alone what’s been paid and is owed on each bill.

With our extremely busy lifestyles, it’s nearly impossible to remember everything, which is why you must use some type of tracking system to avoid playing the guessing game with your finances.

Remember, this is your livelihood we’re talking about, and you only get so many years to get it right.

There are three simple but powerful ways that I strongly recommend for tracking your income and expenses.

Let’s briefly cover them now…

WAY 1: Financial Software

I know that learning how to use software can be a bit intimidating due to the learning curve associated with them.

However, the benefits far outweigh the effort needed to become proficient with the applications.

You’d be pleased to know that financial software has come a long way and are more user-friendly than ever.

Entering your income and expenses into an application helps you avoid mistakes.

These financial apps allow you to group your finances into categories and charts, which gives you the power to see where your money is going.

For example, if you spend a lot of money on eating out, you can put this in as a category, and you’ll know exactly how much you’re spending so you can make adjustments.

Consciously, you may not be aware that the $10 you spend on lunch five days per week is costing you $200 per month. However, financial software would instantly make you aware of this within seconds.

This is the reason why you shouldn’t rely on your memory to track your finances.

In that example, within 12 months you’d spend around $2400 on lunch, which could be going to savings.

A financial application could point out that money leak, and you’d be the wiser to make the adjustment by taking your lunch to work and saving that cash instead.

Knowing where your money is going truly does give you the power and you’ll start to see that it is possible to save when you have your financial picture available on-demand at a moment’s notice.

Financial applications are available in the form of downloadable software, online or cloud-based, or mobile apps.

Don’t allow yourself to become overwhelmed by all of the options, just chose the one that resonates with you the most after giving each type a try.

WAY 2: Expense Tracking Mobile Apps

Financial mobile apps provide some of the same tracking features as desktop and cloud-based software.

Believe it or not, some of those apps can track your income, expenses, savings, investments, debt payoffs, etc.

And all from your mobile device.

How cool and convenient is that?

Just imagine improving your financial health all from the palm of your hand.

By the way, some of the cloud-based financial applications provide mobile apps that sync them together, so that whatever changes you make on one reflects on both.

If you’re a tech-savvy person, then you may want to consider using a financial mobile app.

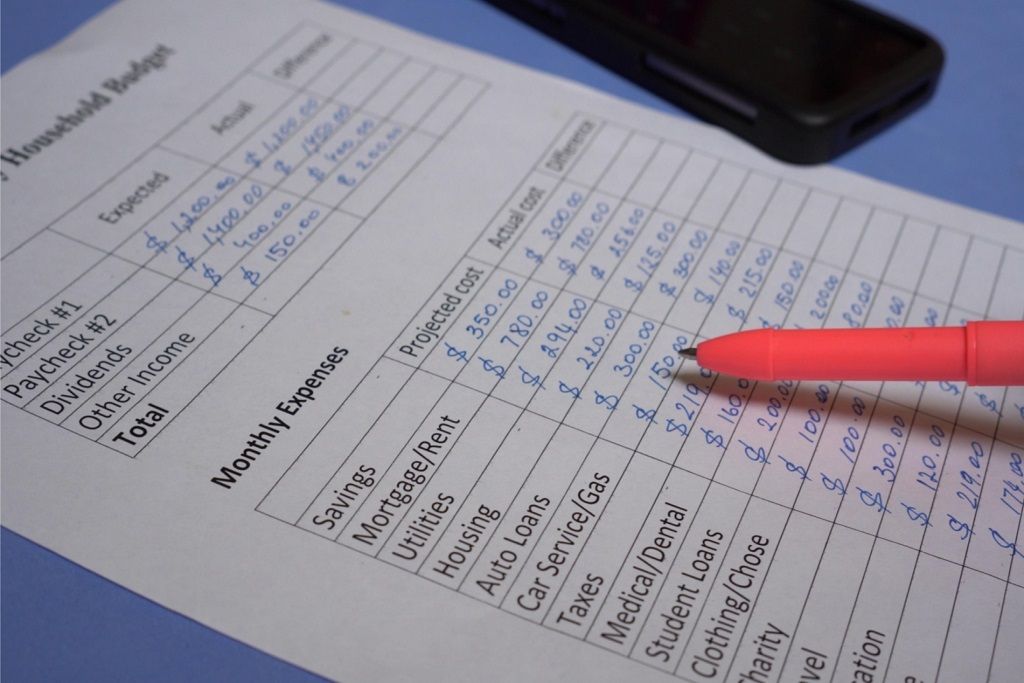

WAY 3: Pencil and Paper

If you prefer the traditional way of tracking your finances, then using a pencil and paper is the perfect solution.

There’s nothing wrong with using old-school methods because the goal is to manage your money.

Your cash doesn’t care if you’re using a software program or a piece of paper.

You’d be amazed at how many people use physical journals to track their income and expenses.

And you know what, a lot of them are laughing all the way to the bank using this low-tech method of money management.

You can use a fancy Finance Journal, Regular Tablet, or a downloadable printable Monthly Bill Tracker to record your expenses.

What I like about monthly bill trackers is their ease of use, which means no learning curve is involved.

You simply print a copy for the month and record your bill details.

That’s it!

Choose the low-tech pencil and paper method if you prefer to use a simple approach to managing your bills.

Conclusion

We’ve covered three of the best ways for you to manage your monthly finances.

Now, all you have to do is determine which method interests you the most.

Regardless of whether you use desktop software, online, mobile apps, or a downloadable printable Monthly Bill Tracker to record your expenses, you’ll be empowered to take control of your personal finances.

Tracking allows you to manage your cash flow, save, pay off debt, and reduces stress all without playing the guessing game.

Knowing where every penny goes can help you avoid wasting thousands of dollars on self-created expenses such as eating out.

Just imagine saving thousands of dollars per year all because you started tracking your finances, especially when you thought it wasn’t possible.

You have many options to choose from and based on my experience, the less complicated methods seem to work best.

If you’re interested in a simple way to manage your bills, then I highly recommend checking out this Monthly Bill Tracker.

Just get started, because you only have so much time to take control of your financial livelihood.

Download Our Free E-book!